Ladies and Gentlemen, a new era begins: Digitalisation of Money.

Money represents a medium of exchange and its current form is paper based, which somehow is primitive, considering that nowadays we are talking about developments such as Artificial Intelligence (AI) and Self-Driving Vehicles.

In today’s blog, I will elaborate on Cryptocurrencies, which is basically Digital (Paperless) Money. The structure is the following:

- Brief History of Money;

- Bitcoin’s Meteoric Rise;

- Top 6 Cryptocurrencies

1. Brief History of Money

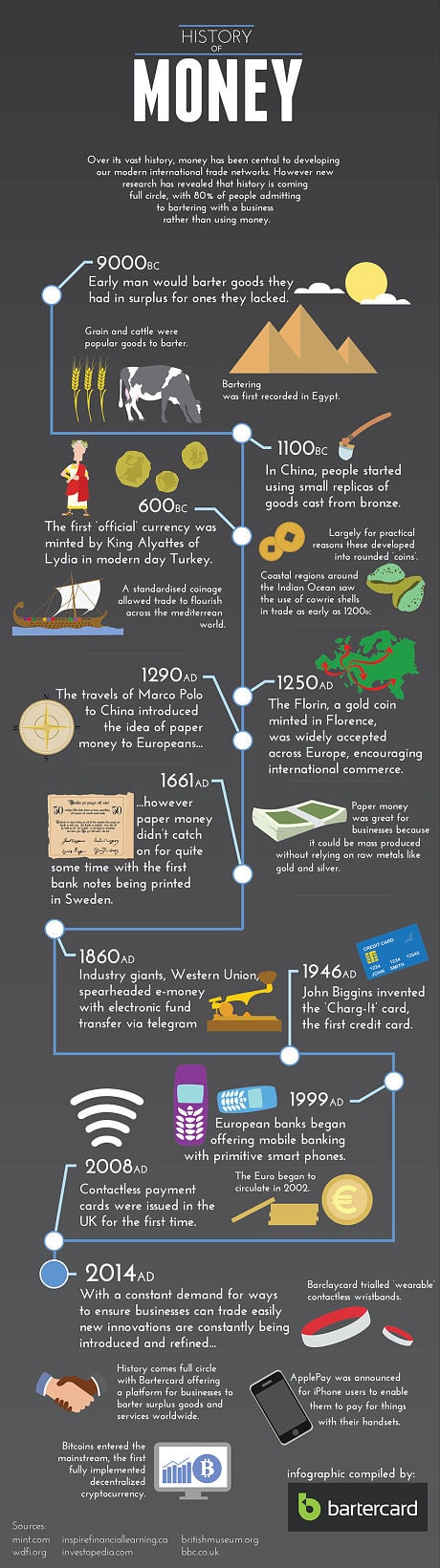

Money has been actively part of our history for the past 3,000 years, period in which forms of trading such as Bartering (exchanging grains for cattle) took place, which later evolved into coins / currency.

One of the first recognised official currencies, minted in coins, was around the year 600 B.C. by the King Alyattes of Lydia (positioned where Turkey is today). The coins were made by a combination of precious metals, such as gold and silver, called electrum.

Then, in the year 1.200 B.C. the Chinese started printing paper money on which a symbolic motto was written: “All counterfeiters will be decapitated“. Fast-forward from the year 1.200, in the year 1946 the very first credit card was introduced, followed by mobile banking payments in 1999, the introduction of Euro currency in 2002, and contactless payment cards issued in 2008.

In the year 2009 the cryptocurrency Bitcoin was invented by Satoshi Nakamoto, followed by mainstream adoption in 2014, when also financial services were launched such as ApplePay and wearable payment wristbands.

Today, in the year 2017, we are experiencing a global and revolutionary phenomenon: the digitalisation of money, and the adoption of Bitcoin as a store of wealth and a decentralised digital payment system, at a very rapid rate.

2. Bitcoin’s Meteoric Rise

*An introduction into Bitcoin, how it works and its main advantages, is available for the readers in my other blog: Blockchain 101.

Let’s start with Bitcoin’s origins. Bitcoin first started being traded on 17 March 2010 valued at that time at $0.003 per Bitcoin. This period represented its infancy when most of the population did not know of its existence. Then, less than 9 months later, on the 31 December 2010, it registered a Meteoric Rise of over 9,500% being traded at $0.29.

I have an absolutely stunning example for you of the first practical use of Bitcoin. Are you ready to absorb this?

- Back in the day when Bitcoin was just launched, on the 22 May 2010 a developer bought 2 pizzas, in exchange of 10,000 Bitcoins.

- 10,000 Bitcoins in 2010 were valued at $40

- The person who bought the 2 pizzas for the developer even paid $25

- Today 10,000 Bitcoins (valued at $19,759 per Bitcoin) are estimated to be worth: $197,590,000

- If only the developer would have kept the 10,000 Bitcoins and not spent them…today he would have been a multi-millionaire with almost $200 million in his bank account

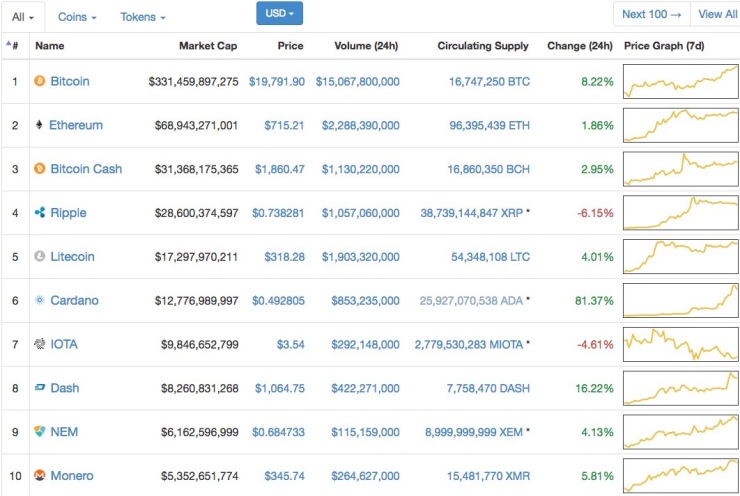

Bitcoin price is currently at $19,759 per Bitcoin (at the time of writing) with a market capitalisation of over $330 billion and a volume of trading in the last 24 hours of $15 billion, according to CoinMarketCap.com.

Compared to the last year in December 2016 Bitcoin was traded at a price of $742 resulting in a Year-over-Year (YoY) growth rate of over 1,600%.

Now you might think that a gain of 1,600% Year-over-Year is significant, however we need to put in context with the markets on Wall Street, such as the New York Stock Exchange. Bitcoin has achieved a rise of 849.9% in the last year, compared to the leading Wall Street financial indices which gained only double digits. The NASDAQ Composite is up 28.91% in the last one year, the Dow Jones is up 24.27%, and the S&P 500 is up 19.31% in the same period, outperforming Wall Street by at least a 820% difference.

- This performance is METEORIC AND EXPLOSIVE

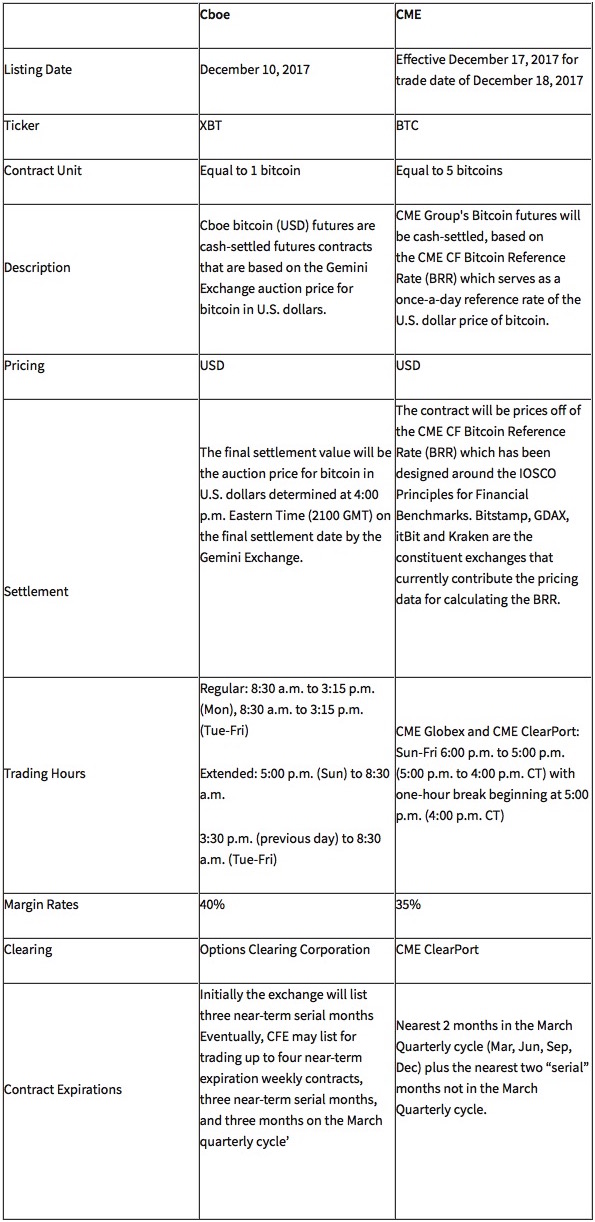

To be mentioned is that Bitcoin price began rising dramatically in 2017 after the announcements that Bitcoin Futures will be traded on the 4 December Chicago Board Options Exchange (CBOE) on the 10 December 2017 and on the 31 October the Chicago Mercantile Exchange (CME) on the 18 December 2017.

In November the price of one Bitcoin was $6,447 and it began climbing after the CME announcement. In the beginning of December after the CBOE announcement the price of one Bitcoin was $9,916, according to CoinDesk.com . These announcements basically legitimise Bitcoin to be traded as a future contract, and bring more confidence for investors. Here’s what you need to know, according to Investopedia:

Bitcoin market is extremely volatile and sensitive to any announcements in the news and social media, therefore the effect of both announcements led to an increase between 100% and 200% in less than 2 months.

This unimaginable growth led to important financial figures in the industry, such as Jamie Dimon the CEO of JP Morgan Chase & Co to declare “Bitcoin is a fraud that will eventually blow up“. Therefore, Bitcoin is considered a “Bubble”. Let me show you why.

Compared to all the bubbles in the last 4 decades, Bitcoin had the shortest (within 6 years) and the most steepest rise (over 1,500%). Compared to the Internet or Dot.Com bubble which burst in 2000 from a total market capitalisation peak of $2.948 trillion has fallen to $1.193 trillion, which meant a loss of $1.755 trillion.

Currently Bitcoin’s total market capitalisation is “only”

3. Top 6 Cryptocurrencies

Currently there are 1360 cryptocurrencies listed which are traded over 7538 markets, according to CoinMarketCap.com, with a total market capitalisation of $594 billion, with a total volume traded in the past 24 hours of $32.5 billion, while Bitcoin dominating the market with a share of 55.6%

A brief overview of the top 6 cryptocurrencies, based on their speed, costs and scalability of transactions, is presented in the figure below:

Conclusion

In my opinion I believe that cryptocurrencies represent a major shift from the traditional centralised banks and third party payment providers to a Peer-to-Peer, faster transfers, less regulated, more anonymous, and less costs network.

However, I believe that there are many challenges on the way for mass adoption of Bitcoin, for example, due to what I think numerous concerns, such as:

- Environmental Issues: Energy consumption & CO2 emissions;

- Hacker attacks;

- Speculation;

- Money laundering;

- Terrorism financing;

- Transactions Anonymity (to a certain degree, depending on cryptocurrency used).

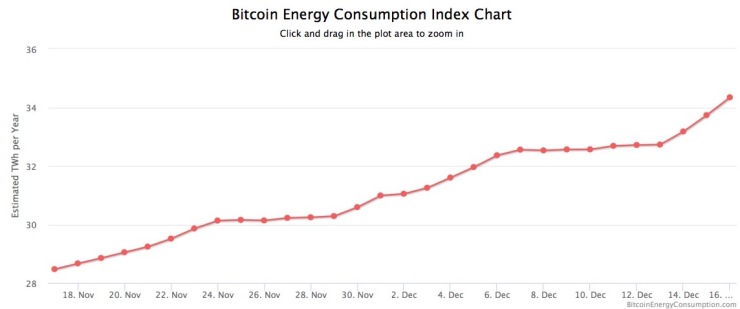

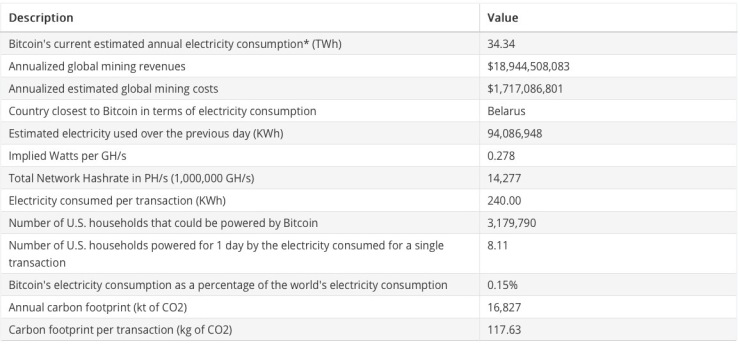

For example, according to Digiconomist the Bitcoin Energy Consumption Index Chart reveals that all the mining of new Bitcoins in 2017 consumed the total energy which could power for a full year, a country like Belarus, with a population of 9,5 million people. Additionally, per each transaction, a staggering 117 kilograms of CO2 are emitted. If we consider that in the period Dec 2016 to Dec 2017, over 290 million transactions were made, than we can conclude Bitcoin is a great threat to pollution and global warming due to mining.

Additionally, a lot of Bitcoins have been stolen due to hacker attacks. An overview with all the hacker attacks is presented in the table below:

Therefore, I think that we are headed to a revolution in the cash currency market, and that local governments are working extensively to create their own cryptocurrency.

We shall yet to see what impact will have Blockchain and Cryptocurrencies on digitalisation, on global supply chains and implicitly on Control Towers. I think that the Supply Chain Control Towers will have a leading role in executing and monitoring all financial transactions based on crypto and Blockchain, with the following benefits:

- Transparent and Secured ledger / database;

- Lightning fast money transfers regardless of global position (within minutes);

- Reduced 3rd party fees;

- Accurate tracking and reporting on Financial Performance / KPI’s;

- Achieve full Visibility within the supply chain: sourcing, production, sales, etc.

In the end, I believe that once the Bitcoin bubble will pop, and after cryptocurrencies will be introduced for the Euro, Dollar, Yen and Ruble, it might potentially result, in the next 5 to 10 years, in the adoption of One Single Digital WorldWide Currency predicted, to a certain degree, by The Economist cover in 1988.